When you hear "Vivint in trouble," it sounds like a company on the brink. But the truth is more complicated than headlines suggest. Vivint isn’t collapsing - it’s being absorbed. And that’s not a sign of failure. It’s a strategic pivot forced by the brutal economics of smart home security.

Why people think Vivint is in trouble

The confusion starts with numbers that look bad on paper. Vivint had negative equity of over $1.7 billion in 2022. That means if you added up everything the company owned and subtracted everything it owed, the result was negative. For most businesses, that’s a death sentence. Banks won’t lend. Investors run. But Vivint isn’t a typical business. Its business model is built on long-term contracts. Customers sign up for 36 to 60 months of monitoring and automation services. Vivint spends $900 upfront to install equipment and win each customer. But over the life of that contract, each customer brings in $2,500 to $3,000. That’s a solid return - if you can survive the upfront cost. The problem? That upfront cost eats cash. Vivint burned through money for years trying to grow. Even as revenue jumped from $1.48 billion in 2021 to $1.68 billion in 2022, the company still lost $51 million that year. It wasn’t losing customers - it was losing money on new ones. That’s why analysts kept saying Vivint couldn’t survive on its own.The real turning point: NRG Energy stepped in

In October 2022, everything changed. NRG Energy, a Fortune 500 utility company with $31 billion in annual revenue, announced it was buying Vivint for $5.2 billion. That’s not a rescue. It’s a merger of two very different companies with one goal: control the home. NRG doesn’t care about Vivint’s negative equity. What it cares about is the 1.9 million households already paying monthly fees. Those are recurring customers. That’s gold in the home services business. NRG already sells electricity, gas, and HVAC systems. Adding Vivint’s smart security, thermostats, and cameras lets them bundle everything into one monthly bill. Suddenly, Vivint isn’t a standalone company struggling to break even - it’s a profit engine inside a much bigger machine. The deal made sense for both sides. Vivint got financial stability. NRG got instant access to a nationwide customer base with high retention rates. Vivint’s attrition rate in Q1 2022 was 11.2%, better than ADT’s 12.1%. That means customers stick around. And when they do, they spend more - on upgrades, extra cameras, smart locks.How Vivint compares to the competition

Vivint isn’t the biggest player in smart home security - ADT is. But it’s not the worst either. Here’s how it stacks up:| Company | Market Share | Revenue Growth (2022) | Attrition Rate | Customer Acquisition Cost |

|---|---|---|---|---|

| Vivint | 8.2% | 14.7% | 11.2% | $900 |

| ADT | 26.7% | 2.1% | 12.1% | $750 |

| Alarm.com | 6.5% | 26% | Not disclosed | $600 |

| Frontpoint | 9.1% | 11.5% | 10.8% | $700 |

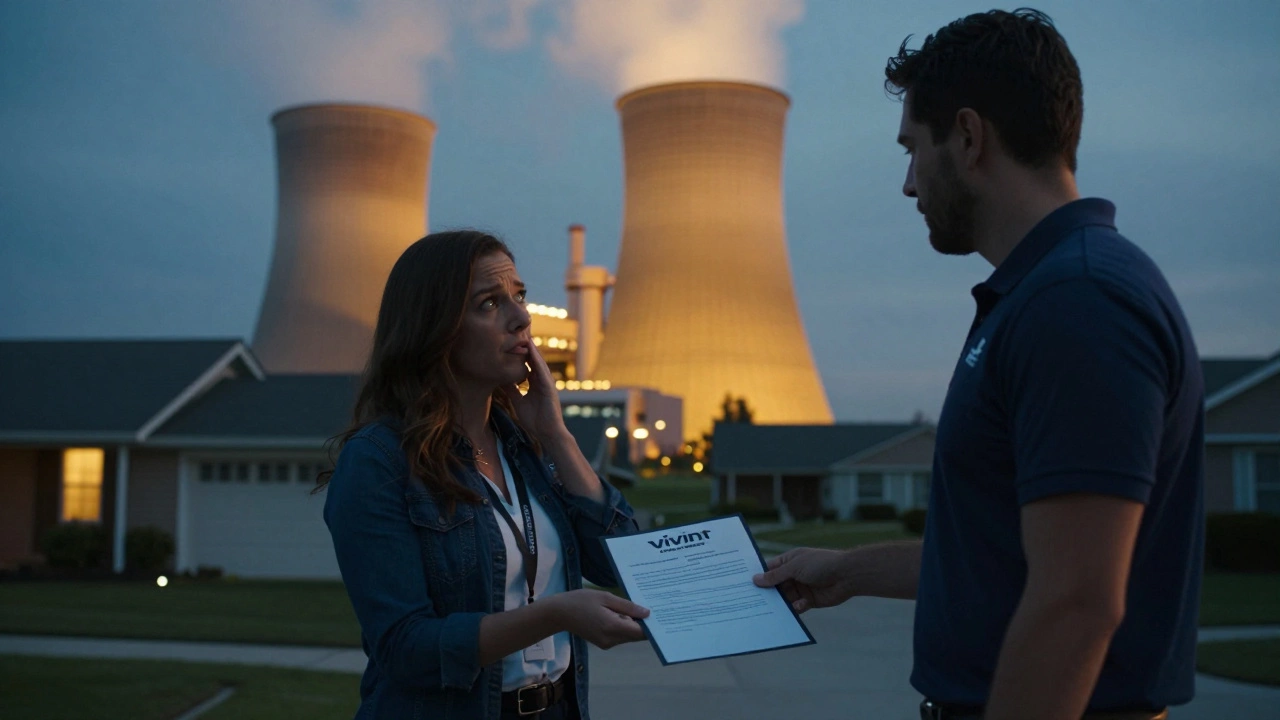

Customer experience: Love it or hate it

If you’re a Vivint customer, your experience depends on who you talk to. On one side, users praise the system’s reliability. One customer in Phoenix had a water leak detected by their Vivint sensors - saving $47,000 in damage. The mobile app has a 4.6/5 rating on iOS. The monitoring center responds fast. The equipment is high-end. On the other side, complaints are loud and consistent. Trustpilot gives Vivint a 3.2/5. The Better Business Bureau gives it an F rating. Why? Three things keep coming up:- Aggressive sales tactics. Door-to-door reps often spend 90 to 120 minutes selling. Some customers say they were pressured into signing contracts they didn’t fully understand.

- Hard-to-cancel contracts. The 60-month contract comes with a $300 early termination fee. If you move or change your mind, you’re stuck.

- Price hikes after the first year. Many customers report their monthly bill jumping $10-$20 after the promotional period ends. Some say they weren’t told this upfront.

Is Vivint still a good choice in 2025?

If you’re thinking about signing up today, the answer isn’t simple. Pros: The equipment is top-tier. The app is easy to use. Monitoring is 24/7 and fast. The system integrates well with Alexa, Google Home, and Apple HomeKit. If you want a fully managed, hands-off smart home, Vivint still leads. Cons: You’re locked in. The upfront cost is high. You’re paying for a sales model that’s expensive - and that cost gets passed to you. And while NRG’s ownership brings stability, it also means Vivint is no longer focused on winning new customers. It’s focused on keeping the ones it has. If you’re looking for flexibility, consider SimpliSafe or Ring Alarm. They’re cheaper, month-to-month, and DIY. But they don’t offer the same level of professional monitoring or integrated automation.

What’s next for Vivint?

Vivint isn’t going away. It’s becoming part of something bigger. NRG plans to integrate Vivint into its home services platform by 2025. That means you might soon get your security, electricity, and heating all on one bill. NRG is investing $150 million in synergies - meaning they’ll cut costs and boost efficiency. The long-term outlook? Vivint will keep growing - but not as a standalone brand. It’ll grow as a feature inside NRG’s ecosystem. That’s good for customers who want convenience. It’s bad for those who want choice. The smart home market is consolidating. Companies that can’t pay for growth on their own are being bought. Vivint didn’t fail. It just couldn’t win the game alone. Now, it’s playing a different one - and it’s got a much bigger team behind it.Should you cancel your Vivint service?

If you’re happy with the service and don’t mind the contract, stay. The system works. The monitoring is reliable. And with NRG behind it, support won’t disappear. If you’re frustrated by the contract, the price hikes, or the sales pressure - now’s the time to look at alternatives. But don’t cancel just because you heard Vivint is "in trouble." It’s not. It’s just changed hands.What to watch for in 2026

Keep an eye on these three things:- Monthly pricing. Will NRG keep raising fees after the first year? Or will they bundle services to make the cost feel fairer?

- Customer support. Will Vivint’s service quality improve now that it’s part of a larger company with more resources?

- Integration. Will you be able to pay for Vivint through your NRG utility bill? That could be a game-changer for convenience.

Is Vivint going out of business?

No. Vivint was acquired by NRG Energy in October 2022 for $5.2 billion. It’s not shutting down - it’s being integrated into a larger energy and home services company. Vivint’s brand, technology, and customer base are all still active and growing under NRG’s ownership.

Why does Vivint have negative equity?

Vivint spent billions upfront installing equipment and acquiring customers on long-term contracts. The money it earned from monthly fees didn’t cover those costs fast enough, leading to a negative net worth on paper. This is common in subscription-based businesses that require heavy initial investment - but it made Vivint vulnerable to acquisition by a company like NRG with deeper pockets.

Is Vivint more expensive than ADT?

Yes, upfront and over time. Vivint’s customer acquisition cost is around $900, compared to ADT’s $750. Vivint also tends to have higher monthly fees after promotional periods end. But Vivint’s equipment is more advanced, and its monitoring response time is often faster. You’re paying for integration and service quality, not just security.

Can I cancel my Vivint contract without paying a fee?

Generally, no. Vivint’s standard contract is 60 months with a $300 early termination fee. Some exceptions exist - like if you’re relocating overseas or if the company violates its own terms - but most customers must pay the fee. Always read your contract carefully before signing.

Is Vivint’s equipment better than competitors?

Yes, in terms of integration and quality. Vivint’s sensors, cameras, and smart locks are proprietary and designed to work seamlessly together. Competitors like Ring or SimpliSafe use third-party devices that may not integrate as smoothly. Vivint’s system is more like a full home automation suite, while others are more like basic alarms with apps.

Does NRG Energy own Vivint now?

Yes. NRG Energy completed its acquisition of Vivint in early 2023. Vivint now operates as a subsidiary under NRG’s home services division. This means Vivint customers may eventually see bundled billing with electricity or heating services, but the Vivint brand and support team remain unchanged for now.